The Benefits of Investing in Indian ETFs: What You Need to Know

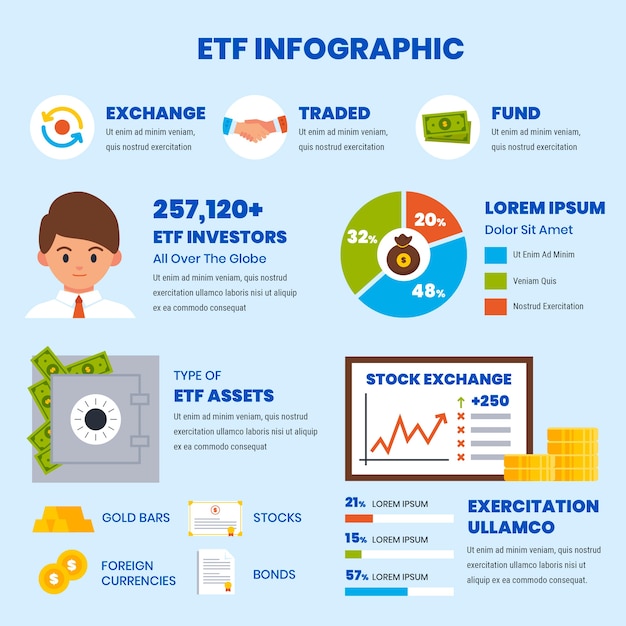

Are you looking to make a wise and profitable investment? Investing in Indian ETFs could be the answer. Exchange-traded funds, or ETFs, offer a unique way to diversify your investments and become a part of the booming Indian economy. ETFs are a special investment vehicle structured like a mutual fund but trades like a stock. Investing in Indian ETFs can give investors access to a range of Indian stocks, bonds, and other securities, giving them the potential to benefit from the growth of the Indian markets. This article will provide you with the information you need about the benefits of investing in Indian ETFs, including the advantages of diversification and the potential for high returns.

Advantages of Investing in Indian ETFs

ETFs are a great way to diversify your portfolio and get exposure to the Indian markets. They are low cost, liquid, and tax-efficient investments. They also offer access to a wide range of Indian stocks, bonds, and other securities. Investing in Indian ETFs allows investors to benefit from the growth of the Indian markets without having to buy individual stocks.

The first benefit of investing in Indian ETFs is that they offer diversification. Investing in ETFs can spread risk across a variety of different assets, reducing the risk of losses. By investing in a range of ETFs, investors can build a well-diversified portfolio that can help them achieve their long-term investment goals.

Another advantage of investing in Indian ETFs is that they are relatively low cost. ETFs typically have lower expense ratios than other types of mutual funds, making them cost-effective investments. Additionally, ETFs are traded on the stock exchange, so investors can buy and sell shares quickly and easily. This makes them a great choice for investors looking for a way to get started in the markets without spending a lot of money.

Finally, ETFs are tax-efficient investments. Since ETFs are structured as funds, investors are not required to pay capital gains taxes on their investments. This makes ETFs a great choice for investors looking to minimize their tax burden.

Diversification Benefits

Diversification is an important part of any investment strategy. Investing in ETFs can help investors diversify their portfolios and spread their risk across a variety of different assets. By investing in a range of ETFs, investors can benefit from the growth of the Indian markets without having to buy individual stocks.

ETFs also offer investors the ability to invest in different types of securities. Investors can choose from a range of ETFs that track stocks, bonds, commodities, currencies, and other types of investments. This gives investors the opportunity to diversify their portfolios and gain access to a wide range of investments.

Additionally, ETFs are traded on the stock exchange, which means that investors can buy and sell shares quickly and easily. This makes them a great choice for investors who are looking for a way to get started in the markets without spending a lot of money.

Tax Benefits of Investing in Indian ETFs

In addition to the diversification benefits, investing in Indian ETFs can also provide investors with tax benefits. Since ETFs are structured as funds, investors are not required to pay capital gains taxes on their investments. This makes ETFs a great choice for investors looking to minimize their tax burden.

Furthermore, ETFs are tax-efficient investments. They are subject to the same long-term capital gains tax rates as stocks, but their gains are taxed at a lower rate than mutual funds. This means that investors can keep more of their money and enjoy a higher return on their investments.

Finally, ETFs are not subject to the same tax reporting requirements as mutual funds. ETFs are not required to file Form 1099s, which means that investors can avoid having to file a tax return for their investments.

Types of Indian ETFs

When it comes to investing in Indian ETFs, there are a variety of different types available. Investors can choose from ETFs that track stocks, bonds, commodities, currencies, and other types of investments. The most common types of Indian ETFs are:

- Equity ETFs: These ETFs track the performance of Indian stocks and are a great way for investors to gain exposure to the Indian stock market. • Fixed Income ETFs: These ETFs track the performance of Indian bonds and are a great way for investors to gain exposure to the Indian bond market. • Commodity ETFs: These ETFs track the performance of Indian commodities and are a great way for investors to gain exposure to the Indian commodity market. • Currency ETFs: These ETFs track the performance of Indian currencies and are a great way for investors to gain exposure to the Indian currency market.

Strategies for Investing in Indian ETFs

When it comes to investing in Indian ETFs, there are a variety of different strategies that investors can use. Some of the most common strategies include:

- Buy and Hold Strategy: This is a long-term strategy in which investors buy and hold ETFs for an extended period of time. This strategy allows investors to benefit from the growth of the Indian markets over time.

- Dollar-Cost Averaging: This is a strategy in which investors buy ETFs in regular intervals, such as monthly or quarterly. This strategy allows investors to reduce their exposure to market risk and benefit from the long-term growth of the Indian markets.

- Sector-Based Investing: This is a strategy in which investors focus their investments on specific sectors of the Indian economy, such as technology, healthcare, or real estate. This strategy allows investors to benefit from the growth potential of specific sectors of the Indian economy.

- Active Trading: This is a strategy in which investors buy and sell ETFs frequently in order to take advantage of short-term market movements. This strategy can be risky, but it can also be a great way to make profits in the short-term.

Risk Factors to Consider

While investing in Indian ETFs can be a great way to diversify your portfolio and benefit from the growth of the Indian markets, there are some risks that investors should be aware of. Investing in ETFs is subject to market risk, which means that the prices of the ETFs can go up and down depending on the performance of the markets. Additionally, ETFs are subject to liquidity risk, which means that investors may not be able to easily buy or sell ETFs when they want to.

Finally, it is important to remember that ETFs are not a guaranteed investment. The prices of ETFs can go up or down depending on the performance of the markets, and investors can lose money if the markets go down. It is important to do your research and understand the risks of investing in Indian ETFs before investing.

Tips for Investing in Indian ETFs

If you are considering investing in Indian ETFs, there are a few tips that can help you make the most of your investments.

- Do your research: Before investing in Indian ETFs, it is important to do your research and understand the risks and potential rewards of investing in Indian ETFs. It is also important to understand the different types of ETFs available and how they can fit into your overall investment strategy. • Diversify your portfolio: Investing in a range of Indian ETFs can help you diversify your portfolio and spread your risk across a variety of different assets. This can help reduce the risk of losses and maximize your potential returns. • Consider the fees: ETFs typically have lower expense ratios than other types of mutual funds, but it is still important to consider the fees associated with investing in ETFs. Make sure to compare the fees of different ETFs before investing. • Use stop-loss orders: Stop-loss orders can be a great way to protect your investments from large losses. Stop-loss orders can be used to automatically sell your investments if they fall below a certain price.

Conclusion

Investing in Indian ETFs can be a great way to diversify your portfolio and benefit from the growth of the Indian markets. ETFs offer a range of advantages, including diversification, low costs, and tax efficiency. Additionally, there are a variety of different types of Indian ETFs available, allowing investors to choose the type of ETF that best fits their investment goals. However, it is important to remember that investing in ETFs is subject to market risk, and investors can lose money if the markets go down. By doing your research and understanding the risks, you can make the most of your investments in Indian ETFs.